Top 10 Digital Signage Manufacturers to Watch in 2025 & Their Innovation Directions

(Based on industry trends from ISE 2025, CES 2025, market share data, and technological breakthroughs)

1. Samsung Electronics

Core Strengths: Samsung leads in AI integration, MicroLED technology, and IoT ecosystems. Its SmartThings Pro and VXT platforms support AI-driven device management, while the latest MicroLED displays (such as 8K RGB backlight models) excel in brightness and energy efficiency.

Innovation Directions: Transparent OLED screens, AI-powered video generation platform (10km.ai), and quantum computing-based ad content optimization.

2. LG Electronics

Core Strengths: Known for transparent OLED and Kinetic LED technology, LG offers high-brightness, energy-efficient solutions for retail and outdoor displays. Its transparent OLED screens are integrated into high-end furniture and museum settings, enhancing interactivity with touch technology.

Innovation Directions: Flexible displays and AI-driven dynamic content generation (e.g., real-time ads based on weather and foot traffic).

3. Daktronics

Market Position: A specialist in customized signage for stadiums and transportation hubs, known for high durability and scalability. It holds a strong market share in the global transportation and sports industries.

Trend Development: Advancing interactive displays and motion-sensitive technology for large-scale events and real-time information updates.

4. BOE (Beijing Oriental Electronics)

Technological Breakthroughs: AI-powered media centers capable of restoring old videos and displaying 4K ultra-HD content. Its collaboration with Qualcomm on SoM core boards enhances the integration of smart homes and digital signage.E-paper

Application Scenarios: Immersive experiences in retail and information screens in public spaces.

5. BrightSign

Specialty Areas: Media player hardware with AI chips (such as the XC5 series NPU chips) supports remote device management and comes with a five-year warranty, extending device lifecycle.

Industry Impact: High-efficiency hardware that reduces total cost of ownership, widely adopted in chain retail and the restaurant industry.

6. SignageOS

Software Leadership: A leader in remote device management (RDM), offering AI-based monitoring of hybrid device networks and simplifying centralized control of multi-brand screens, adopted by giants like Samsung.

Future Directions: Enhancing cross-platform compatibility and deeper integration of IoT sensors with digital signage.

7. PPDS (Philips Professional Display Solutions)

Innovative Products: Introduced a QSR menu board that eliminates the need for LED controllers, streamlining installation. AI-powered dynamic art displays enhance engagement in museums.

Market Strategy: Strengthening customer retention through subscription-based services like Philips Wave.

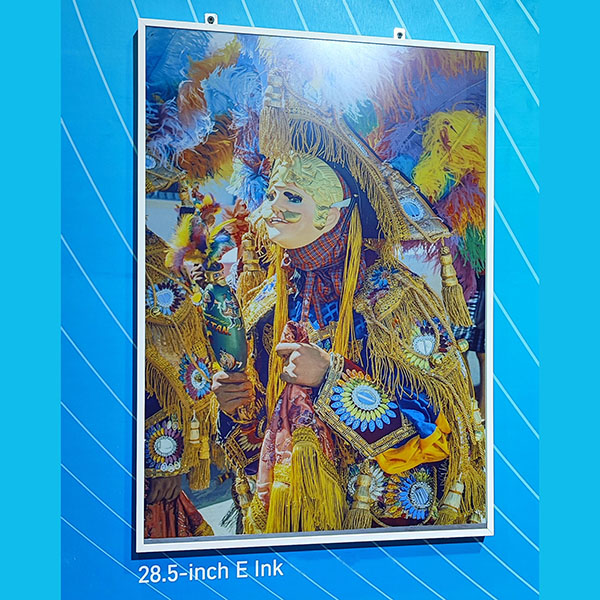

8. E Ink (Yuantai Technology)

Technology Leadership: The dominant supplier of e-paper displays, with its Spectra 6 (indoor) and Kaleido (outdoor) technologies widely adopted by Samsung, Sharp, and others, driving the trend toward sustainable signage.

Expanded Applications: 75-inch outdoor e-paper screens and standardized paper-size designs as replacements for traditional printed posters.

9. Sharp-NEC (Sharp NEC Display Solutions)

Product Highlights: Standardized electronic paper displays (such as A4-size models) and OPS-PC upgradeable hardware, extending device lifespan.

Market Positioning: A specialist in interactive displays for education and corporate communication.

10. Panasonic

Emerging Fields: Debuted an All-in-One LED screen, challenging the LCD market. Integrated projection and mist-screen technology to create immersive displays.

Sustainability Efforts: Prototyped solar-powered signage and low-energy LED technology in response to green trends.

Other Notable Manufacturers

TrinWare & KIOSK & DISPLAY: Jointly ranked first in Metoree 2025, specializing in interactive kiosks and portable signage, ideal for retail and healthcare environments.

Nexmosphere: An IoT sensor expert integrating with Samsung’s VXT platform, advancing "pick-and-show" interactions in smart retail.

Absen: Capturing attention with large-scale LED art installations, such as AI-driven data artworks by Refik Anadol, expanding digital signage’s artistic applications.

Industry Trend Summary

AI & Content Generation: AI is penetrating the entire industry chain, from device management to dynamic advertising.

Sustainable Technologies: E-paper, solar-powered signage, and recyclable materials are becoming mainstream.

Interactivity & Immersive Experiences: 3D displays, AR integration, and voice control are redefining user engagement.

Software-as-a-Service (SaaS): Remote management and subscription-based models are driving aftermarket revenue for hardware companies.

The Relationship Between Electronic Shelf Labels (ESL) and Digital Signage

Electronic Shelf Labels (ESL) and Digital Signage both belong to the category of digital information display technologies. However, they differ significantly in terms of core functions, application scenarios, and technological characteristics. At the same time, they exhibit a degree of complementarity and a trend toward technological integration. The following is an analysis of their relationship:

1. Core Functions and Positioning

Electronic Shelf Labels

Core Function: Primarily used in retail environments for dynamic price and promotional information updates, replacing traditional paper labels. For example, ESLs allow real-time price adjustments via Bluetooth or cloud-based systems, reducing labor costs and improving efficiency.

Technological Features: Uses e-paper (electronic ink) displays, characterized by low power consumption and static display, consuming energy only during refreshes. The battery life can last over 10 years.

Digital Signage

Core Function: Digital signage broadly covers advertising displays, informational screens, and interactive display panels used for public information dissemination (e.g., advertisements, wayfinding, real-time data displays). Examples include large LED billboards in shopping malls or flight information displays at airports.

Technological Features: Relies on LCD, LED, OLED, and other dynamic display technologies, supporting video playback, touch interaction, AI-driven content generation, and more complex functions.

2. Differences in Application Scenarios and Complementarity

Typical Electronic Shelf Labels Applications:

Supermarket shelves (e.g., BOE’s Electronic Shelf Labels solution in Freshippo allows real-time price synchronization).

Fresh produce & cold chain (waterproof and anti-fog designs ensure functionality in low-temperature environments).

Chain stores (centralized management of pricing across multiple locations through a main account).

Typical Digital Signage Applications:

Shopping mall advertising displays (e.g., Samsung’s MicroLED screens for dynamic advertising).

Interactive museum screens (e.g., LG’s transparent OLED for enhancing art exhibitions).

Transportation hub information boards (e.g., Daktronics’ real-time traffic display solutions).

Complementarity: In retail environments, Electronic Shelf Labels is responsible for price management, while digital signage is used for promotional advertisements and branding. Combining both enhances overall operational efficiency and customer experience.

3. Trends in Technological Integration

Cross-Hardware Applications:

Some manufacturers (e.g., BOE and E Ink) provide both Electronic Shelf Labels and digital signage solutions. For example, in Freshippo flagship stores, BOE deploys Electronic Shelf Labels for pricing alongside large video walls and transparent screens for digital signage.

E-paper technology, originally exclusive to Electronic Shelf Labels, is now being applied to low-power digital signage, such as static airport information boards.

Software Platform Integration:

Remote management platforms (e.g., SignageOS) support both Electronic Shelf Labels and digital signage, enabling unified content distribution and monitoring.

For instance, DIGI’s T@POP App allows users to manage both Electronic Shelf Labels pricing and digital signage content updates.

4. Key Differences Summary

| Aspect | ESL | Digital Signage |

|---|---|---|

| Display Technology | E-paper (static, low power) | LCD/LED/OLED (dynamic, high brightness) |

| Interactivity | One-way information display (no touch) | Supports touch, AR, and other interactions |

| Update Frequency | Low (a few times per day) | High (real-time or scheduled updates) |

| Primary Cost | Hardware deployment & long-term maintenance | Content creation & dynamic updates |

5. Future Development Directions

AI-Driven Integration: AI algorithms can synchronize Electronic Shelf Labels price updates with digital signage promotions. For example, based on stock levels or customer traffic, AI can dynamically optimize product displays and advertisements.

Sustainability & Green Technologies: ESL’s e-paper technology and solar-powered digital signage solutions (such as Panasonic’s prototypes) contribute to greener retail environments.

Cross-Scenario Data Integration: Retailers can combine Electronic Shelf Labels sales data with digital signage customer analytics to gain deeper business insights and improve decision-making.

Conclusion

Although Electronic Shelf Labels and digital signage serve different functions, they both contribute to digital transformation in information display. Electronic Shelf Labels focuses on retail efficiency and cost optimization, while digital signage enhances dynamic content delivery and user engagement. The convergence of these technologies and their application synergy will be a key trend in the future.

Based on current information, here are the top 10 Electronic Shelf Label (ESL) manufacturers to watch in 2025, along with their innovative directions and analyses of their integration with digital signage:

1. E Ink Holdings Inc.

Core Strengths: A leading global supplier of electronic paper (E-paper) panels, E Ink's Spectra and Kaleido technologies are widely used in ESLs, especially for low-power and outdoor applications.

Innovative Directions:

Large-Scale E-Paper Displays: Developing 75-inch outdoor electronic paper screens to replace traditional printed posters, aligning with the eco-friendly trends in digital signage.

Color E-Paper Technology: Advancing color electronic paper to enhance the visual appeal of ESLs.

2. Pricer AB

Technical Expertise: Specializes in wireless communication technologies, such as RFID and Bluetooth, offering highly responsive price update solutions.

Innovative Directions:

5G-Enabled ESL Systems: Developing Electronic Shelf Labels systems that support 5G technology to improve data transmission speed and coverage, facilitating real-time updates in digital signage.

3. Samsung Electro-Mechanics Co., Ltd.

Technical Background: Leveraging Samsung's display technology, providing high-brightness LCD electronic labels suitable for specialized environments like fresh food cold chains.

Innovative Directions:

Flexible Display Applications: Exploring the use of flexible displays in ESLs, complementing Samsung's transparent OLED digital signage technology.

4. LG Electronics

Cross-Industry Integration: Combining ESLs with Kinetic LED digital signage to attract customers through dynamic advertising screens while synchronizing promotional pricing via ESLs.

Innovative Directions:

Foldable ESL Tags: Developing foldable Electronic Shelf Labels tags to accommodate various shelf configurations.

5. Panasonic Corporation

Sustainable Technology: Introducing solar-powered Electronic Shelf Labels prototypes, alongside low-energy digital signage solutions, promoting green retail practices.

Innovative Directions:

Integrated Environmental Sensors: Incorporating sensors like temperature and humidity monitors to expand Electronic Shelf Labels applications in cold chain logistics.

6. Displaydata Ltd

Software Platform Integration: Offers solutions that manage both ESLs and digital signage devices, supporting cross-platform content distribution.

Innovative Directions:

ESL and AR Interaction: Promoting interactions between ESLs and augmented reality digital signage, such as triggering AR product displays by scanning ESLs.

7. Opticon Sensors Europe B.V.

Standardized Design: Provides electronic paper labels in standard sizes, facilitating compatibility with standardized digital signage systems, such as educational information displays.

Innovative Directions:

Upgradable Hardware Modules: Developing hardware modules that can be upgraded to extend the lifespan of ESLs and reduce replacement costs for businesses.

8. Teraoka Seiko Co., Ltd.

Market Position: A significant player in the Electronic Shelf Labels market, focusing on providing solutions that enhance retail automation and efficiency.

Innovative Directions:

IoT Integration: Combining ESLs with IoT devices to enable dynamic pricing and real-time inventory management.

9. SoluM

Technical Background: Utilizing advanced display technologies to provide high-quality ESL solutions suitable for various retail environments.

Innovative Directions:

Enhanced Visual Displays: Developing ESLs with improved visual displays to increase customer engagement and information clarity.

10. ZKONG

Market Position: A notable Electronic Shelf Labels provider focusing on integrating ESLs with digital signage to enhance the retail shopping experience.

Innovative Directions:

Cloud-Based Management: Implementing cloud-based systems for centralized management of ESLs and digital signage, allowing for seamless updates and synchronization.

ESL and Digital Signage Integration

Technological Overlap:

Display Technology: Companies like E Ink Holdings Inc. supply electronic paper used in both ESLs and low-power digital signage, such as airport information boards.

Communication Technology: Wireless transmission methods (e.g., Bluetooth, 5G) utilized by ESLs are also foundational for real-time content updates in digital signage.

Application Synergy:

Retail Environments: ESLs manage pricing, while digital signage displays advertisements; both can be integrated through unified platforms for synchronized data.

Logistics and Warehousing: ESLs track inventory, and digital signage provides operational guidance, collectively enhancing efficiency.

Future Trends:

AI-Driven Insights: Combining sales data from ESLs with customer traffic analysis from digital signage to optimize dynamic pricing and advertising strategies.

Sustainable Solutions: The low power consumption of ESLs and solar-powered digital signage support environmental sustainability goals.

Conclusion

ESLs and digital signage create a complementary ecosystem in retail and logistics sectors, with ESLs focusing on detailed operations and digital signage enhancing user experience. Leading manufacturers are driving the deep integration of these technologies through cross-industry innovations and platform unification.